Dune 2 is a masterpiece!

April 26, 2024 ·

< 1 min read

“Dune 2” is not just a film; it’s a cinematic marvel. You owe it to yourself to see … Continue reading “Dune 2 is a masterpiece!”

Introducing Triton Liquid, a spinoff of FJ Labs’ liquid crypto strategy

April 23, 2024 · 2 min read

As discussed in a previous post, I have been an active investor in crypto since 2016 and had … Continue reading “Introducing Triton Liquid, a spinoff of FJ Labs’ liquid crypto strategy”

Helldivers 2 is the best co-op game on the market!

April 19, 2024 · 2 min read

While I love the single player stories in “God of War” and the Rockstar games, there is something … Continue reading “Helldivers 2 is the best co-op game on the market!”

FJ Labs Q1 2024 Update

April 16, 2024 · 5 min read

Friends of FJ Labs, We hope you have been having a fantastic start to the year. We at … Continue reading “FJ Labs Q1 2024 Update”

Episode 45: Ask Me Anything

April 10, 2024 · 64 min read

I had not done an Ask Me Anything (AMA) session in over a year which led to many … Continue reading “Episode 45: Ask Me Anything”

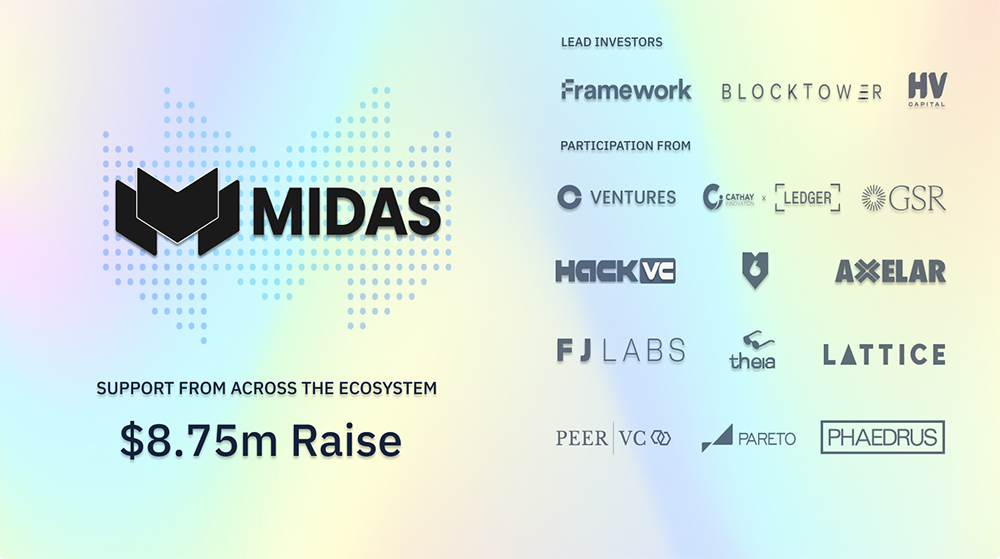

Introducing the latest FJ Labs incubation: Midas

April 2, 2024 · 7 min read

As some of you may know FJ Labs has a startup studio program where we help build companies. … Continue reading “Introducing the latest FJ Labs incubation: Midas”

FJ Labs’ B2B Marketplace Thesis

March 26, 2024 · 7 min read

For consumers, the Internet has made everything cheaper, better, and faster. We have extraordinary user experiences and infinite … Continue reading “FJ Labs’ B2B Marketplace Thesis”

A Thrilling Journey Beyond the Screen: “Tomorrow, and Tomorrow, and Tomorrow” by Gabrielle Zevin

March 19, 2024 · 2 min read

As an entrepreneur deeply immersed in the tech world, I am always on the lookout for stories that … Continue reading “A Thrilling Journey Beyond the Screen: “Tomorrow, and Tomorrow, and Tomorrow” by Gabrielle Zevin”

The Grindas: A Family Affair

March 12, 2024 · < 1 min read

All our lives are the result of an extremely improbable set of events. Despite all the efforts it … Continue reading “The Grindas: A Family Affair”

A Testament to Timeless Genius: “Nightfall and Other Stories” by Isaac Asimov

February 27, 2024 · 2 min read

As someone who has always been fascinated by the intersection of technology, futurism, and human ingenuity, discovering Isaac … Continue reading “A Testament to Timeless Genius: “Nightfall and Other Stories” by Isaac Asimov”

Zero to Billions Techstars Alumni conversation with Alejandro Garcia-Amaya

February 13, 2024 · 35 min read

I was invited to share my journey with the Techstars alumni community. Here are the questions that we … Continue reading “Zero to Billions Techstars Alumni conversation with Alejandro Garcia-Amaya”

3i Member Spotlight Interview

February 6, 2024 · 24 min read

I was recently featured on the 3i Members Founder Spotlight podcast, where I spoke with Eric Rosen and … Continue reading “3i Member Spotlight Interview”

Optimizing Life Post Exit

January 23, 2024 · 42 min read

I recently joined a Post Exit Founders Group with over 1,200 members. They asked me to share lessons … Continue reading “Optimizing Life Post Exit”

FJ Labs Q4 2023 Update

January 18, 2024 · 5 min read

Friends of FJ Labs, Happy 2024! We are excited to dive back in after the holiday season and … Continue reading “FJ Labs Q4 2023 Update”

Episode 44: Unlocking Productivity: Streamlining Your Days for Passion and Purpose

January 16, 2024 · 44 min read

People often ask me how I manage to accomplish so much while leading such a rich, passionate life … Continue reading “Episode 44: Unlocking Productivity: Streamlining Your Days for Passion and Purpose”

1 – 16 of 937 Posts